LTE represents something of a paradigm shift in the wireless

industry from fixed bandwidth carriers to variable bandwidth carriers. This matters to end users because LTE capacity and throughput largely scale with carrier bandwidth.

With nearly all previous mobile airlink technologies -- AMPS,

GSM, IS-136 TDMA, CDMA2000, W-CDMA -- the channel or carrier has been

standardized around a single bandwidth.

To use two examples that are still current, CDMA1X utilizes 1.25 MHz FDD

bandwidth carriers, while W-CDMA uses 5 MHz FDD bandwidth carriers. Even when CDMA2000 and W-CDMA use carrier

aggregation technologies, such as 3xEV-DO or DC-HSPA+, the individual carrier

bandwidths remain fixed and separate, simply tied together at the network and

mobile level via link aggregation.

On the other hand, LTE is currently standardized around six

possible FDD/TDD carrier bandwidths: 1.4

MHz, 3 MHz, 5 MHz, 10 MHz, 15 MHz, 20 MHz.

These multifold bandwidth options more fittingly allow operators around

the world to match LTE to their disparate spectrum allocations and capacity

needs.

In the US, all four major operators are now underway with their

initial LTE deployments. In terms of

current LTE bandwidth, Verizon Wireless (VZW) and Sprint are the most

predictable; AT&T and T-Mobile show more variability.

VZW is originally deploying LTE in its national collection of

Upper 700 MHz C block 11 MHz FDD licenses (band 13). This allows for one 10 MHz FDD carrier in all

of its markets nationwide. VZW’s LTE

bandwidth will become more complicated, however, later this year, as it starts

overlaying AWS 2100+1700 MHz (band 4) acquired from SpectrumCo-Cox and traded

with T-Mobile.

Like VZW, Sprint also has a consistent national collection of

licenses thanks to the PCS 1900 MHz G block 5 MHz FDD licenses (band 25) that

it acquired via Nextel. So, Sprint is

initially rolling out one 5 MHz FDD carrier across its nationwide footprint. But Sprint LTE bandwidth, too, will become

more volatile as time goes on because of its Nextel iDEN shutdown and Clearwire

acquisition. Respectively, those

developments will allow Sprint to deploy SMR 800 MHz (band 26) and BRS/EBS 2600

MHz (band 41) for additional LTE bandwidth.

AT&T is a little bit more interesting right now, as it is

utilizing Lower 700 MHz B block 6 MHz FDD and/or C block 6 MHz FDD licenses

(band 17) for its first round LTE deployment.

AT&T also has used some of its AWS licenses for LTE, but this is so

rare currently that it can be basically disregarded -- though, AWS will be a major play once again if AT&T's just announced acquisition of Leap Wireless is approved. But in most major markets presently, AT&T holds both

aforementioned Lower 700 MHz licenses.

Since both licenses are contiguous, AT&T can bridge the licenses to

deploy one 10 MHz FDD carrier. In other

markets, AT&T holds only one license or the other, thus can deploy one 5

MHz FDD carrier.

Finally, T-Mobile is the new kid on the block with its LTE

overlay. It has considerable market

bandwidth variability and many spectrum synergy opportunities thanks to several

recent spectrum transactions and its MetroPCS merger. As such, T-Mobile’s LTE rollout is currently

the most intriguing of the four and will be the focus of this article.

To begin, T-Mobile is deploying LTE exclusively in its AWS

2100+1700 MHz license (band 4) holdings.

The AWS licenses that T-Mobile controls, thus the bandwidth that it

holds fluctuates greatly from market to market.

Additionally, T-Mobile has deployed and continues to operate W-CDMA

(HSPA+ or DC-HSPA+) primarily in its AWS spectrum.

As a sidebar, contrary to some popular belief, T-Mobile is not

currently shifting all W-CDMA from AWS to PCS.

Such is not possible for several more years, if ever, as T-Mobile must

continue to support millions of devices that are incompatible with PCS

W-CDMA.

In short, T-Mobile has had to refarm selectively some spectrum from

W-CDMA to LTE and/or acquire additional AWS spectrum, and this means that W-CDMA and LTE have

to coexist in AWS for at least the next several years.

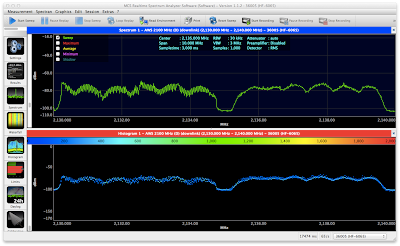

To illustrate, the spectrum analyzer sweep above shows adjacent

AWS C and D blocks, both of which are licensed to T-Mobile in the particular

market in question. The AWS C block is being used for 5 MHz FDD

LTE, as can be seen by the fine tooth comb pattern created by the OFDMA

subcarriers inherent to LTE. Meanwhile, the AWS D block

is hosting W-CDMA, which uses no frequency division subcarriers and features a more rounded shape

from the shoulders of its passband filters.

Variations on this pattern of LTE and W-CDMA coexistence play out in T-Mobile markets around the country. The majority of the rest of this article will home in on detailed breakdowns of current -- and, potentially, future -- T-Mobile LTE bandwidths in several of the larger, more compelling markets. Additionally, it will list current T-Mobile LTE bandwidths in all researched markets, as well as document several problematic markets unless T-Mobile obtains additional AWS spectrum.

1. New York

Current: 5 MHz FDD

Future: 10-20 MHz FDD

Current: 5 MHz FDD

Future: 10-20 MHz FDD

To cut right to the chase, New York is the largest market in the country, but T-Mobile LTE is presently limited to 5 MHz FDD, as depicted in the band plan graphic below:

First, the history is that T-Mobile acquired the AWS A block 10 MHz FDD and E block 5 MHz FDD licenses for New York in the FCC AWS-1 auction in 2006. That total of 30 MHz allowed T-Mobile to run three W-CDMA carriers, including two in the AWS A block that were paired as DC-HSPA+.

Last year, as part of its transaction with SpectrumCo-Cox, VZW entered into a secondary transaction with T-Mobile to swap and realign their respective AWS spectrum holdings to create greater contiguity for both operators. To that end, T-Mobile traded its AWS A block for VZW's AWS F block. During the transition period, T-Mobile continued to the lease the AWS A block and shifted DC-HSPA+ over to the AWS F block. Also, T-Mobile started to refarm the AWS E block for 5 MHz FDD LTE. The AWS F block has to remain DC-HSPA+ because New York is only a 20 MHz PCS market for T-Mobile, meaning that it cannot run two adjacent W-CDMA carriers for DC-HSPA+ in PCS until GSM is completely shut down.

Also last year, T-Mobile announced its merger with MetroPCS, which holds the AWS C block 5 MHz FDD and D block 5 MHz FDD licenses in New York. As can be seen from the band plan diagram, T-Mobile and MetroPCS have significant AWS synergies in New York. But the current bottleneck is that MetroPCS CDMA2000 deployment is in the AWS D block, interrupting its LTE deployment in the AWS C block and T-Mobile's LTE deployment in the AWS E block. And New York is an AWS only market for MetroPCS, meaning that it cannot shunt CDMA2000 operations solely to PCS as it can in other markets. So, in the present, that limits T-Mobile LTE to 5 MHz FDD, but in the next year, a PRL update and spectrum refarming will allow MetroPCS to shift its CDMA2000 to the AWS C block, thereby allowing T-Mobile and MetroPCS to combine their LTE bandwidths in the AWS D and E blocks for 10 MHz FDD.

As another sidebar, T-Mobile has held two press events in New York over the past few months, and both featured 10 MHz FDD LTE. The most recent event this month at Skylight West has been confirmed via LTE engineering screen to have used now VZW's AWS A block license for 10 MHz FDD LTE. T-Mobile's lease of that license was canceled earlier this year, so whether T-Mobile had explicit permission from VZW to use the AWS A block for LTE via the interior microcell for the event is in question and best left for another article. But the primary point is that T-Mobile demonstrated 10 MHz FDD at the event, though it is able to provide only 5 MHz FDD on the streets of New York for the time being.

2. Los Angeles

...to be continued...